By ZHONG NAN Source:China Daily 2023-12-20

A virtual reality headset and handsets are experienced by a visitor to the first China International Supply Chain Expo. [WANG JING/CHINA DAILY]

Combined actions ensure smooth operation of industrial and supply chains

Despite Samsung Electronics Co discontinuing smartphone production in China several years ago, its assembly plants in Bac Ninh Province, Vietnam, receive shipments of phone accessories from China each day at 4 pm.

These electronic parts, packed and shipped from suppliers in the Pearl River Delta region a day earlier, reach Pingxiang land port in the Guangxi Zhuang autonomous region at midnight.

After completing Customs procedures at the Vietnamese border, they are classified, assigned and assembled at the South Korean company's workshops in Vietnam.

The smartphones, complete with various types of charging plugs, are exported to countries worldwide, including China, Saudi Arabia, France, the United States, Brazil and Kenya.

Amid diminishing global demand for goods and disruptions to global supply chains, such shipments illustrate the pivotal role played by Chinese companies in ensuring the smooth operation of industrial and supply chains across the world.

Fueled by the nation's comprehensive industrial chain and international production capacity cooperation, Chinese companies export a substantial quantity of intermediate goods each year.

Huang Lingli, deputy director of the General Administration of Customs' commodity inspection department, said these goods include industrial parts, chemicals, yarns, cables and electronic components. They are sent to a diverse range of economies that include developed and developing nations such as Vietnam, India, South Korea, Mexico and Hungary.

Traditional export categories, including daily necessities and footwear, are giving way to high-tech innovation in the new energy and high-end manufacturing sectors, Huang said. As a result, China's foreign trade is shifting toward sustainability, and this trend has seen many domestic companies expand their global presence.

One of them is Contemporary Amperex Technology Co, which manufactures electric vehicle batteries in Ningde, Fujian province. In addition to announcing that it will build its second factory in Hungary in September, the company said last month it would accelerate its overseas expansion by building a fourth plant in Europe.

As Western countries have elevated global supply chain competition from the microbusiness level to the macro level of national strategy, China has consistently refined its supply chain strategy to remain competitive. This trend is highlighted in a supply chain-themed report published by the China Council for the Promotion of International Trade at the first China International Supply Chain Expo, or CISCE, which was held in Beijing.

The global gathering, staged from Nov 28 to Dec 2, attracted a total of 515 domestic and global companies, as well as international organizations. The council, which organized the event, said it was attended by 150,000 visitors, including more than 80,000 buyers and professionals.

Chen Xuedong, an academician at the Chinese Academy of Engineering, said China's endorsement of global supply chain cooperation will accelerate the digital and green transformation for domestic and international businesses.

The nation's efforts can catalyze innovation and promote collaboration among numerous stakeholders, Chen added.

A miniature robot is displayed at the expo. [WANG JING/CHINA DAILY]

Central focus

Long Guoqiang, vice-president of the State Council's Development Research Center, said, "The need to enhance the operations of global supply chains has become a central focus for strategic initiatives pursued by businesses and governments across the world."

With widespread emphasis placed on strengthening supply chain resilience in various industries and economies, there is an apparent lack of coordinated efforts to ensure that restructuring initiatives yield a truly robust, resilient and efficient global supply chain network, Long said.

As the world economy is facing the headwinds of deglobalization and the challenge of supply chain restructuring, China has taken measures to remove all restrictive measures on foreign investment in the manufacturing sector. It is using international transportation channels such as the New International Land-Sea Trade Corridor and China-Europe freight train services, as well as hosting the first CISCE, to encourage multinationals to invest in its market.

Ministry of Industry and Information Technology data show the added value of China's manufacturing sector accounted for nearly 30 percent of the global total last year, ranking first in the world for 13 consecutive years.

Ren Hongbin, chairman of the China Council for the Promotion of International Trade, said that based on its large market size, China is committed to providing ample space for global industrial and supply chains to operate.

He said the scarcest resource in the world today is the market, and the size of the market determines the depth of division of labor, which in turn determines the level of industrial development. With a population of more than 1.4 billion and a middle-income group of over 400 million, China is the world's second-largest consumer market.

Fueled by free trade deals and initiatives such as the Regional Comprehensive Economic Partnership agreement and the Belt and Road Initiative, or BRI, many multinationals believe that China will continue to be a crucial gateway to the broader Asia-Pacific region, presenting lucrative business opportunities for global investors.

For example, the BRI has evolved into a well-received international public good and a platform for cross-border cooperation. In the decade since the inception of the BRI, China and other countries have engaged in imports and exports valued at $19.1 trillion, with two-way investments surpassing $380 billion, Ministry of Commerce data show.

Meanwhile, a series of cooperative projects covering agriculture, infrastructure development, energy, the digital economy, and other sectors have effectively helped upgrade industrial structures and optimize industrial chains in various countries and regions.

Early last month, the International Monetary Fund raised its growth projection for the Chinese economy this year from 5 percent to 5.4 percent. Multinational corporations, which accounted for 30.4 percent of China's total foreign trade value from January to November, said they were seeing more export opportunities in areas such as the green economy, advanced manufacturing, and innovation-driven growth in China.

Rajat Agarwal, vice-president of German industrial conglomerate Henkel Group, said that if the current approach of foreign investors in China lies in China, then the next direction for global upgrading is also likely to be in China.

Henkel Group is building an innovation center in Shanghai, which will be the company's second-largest such center in the world when it is completed in 2025, Agarwal added.

In the first quarter of next year, German chemical products manufacturer Covestro will put a new polyurethane dispersal plant in Shanghai into operation.

Thomas Roemer, Covestro's head of business entity for coatings and adhesives, said that in addition to supplying products to domestic manufacturers, the plant will enable the company to seize growth opportunities associated with waterborne systems in the Asia-Pacific region.

"China is, of course, expected to grow faster than many parts of the world, both for the local market and the export market. We have observed a strong inclination toward waterborne systems in the automotive, consumer electronics, packaging and print industries," Roemer said.

Thanks to the lower tariffs resulting from the Regional Comprehensive Economic Partnership agreement, and tangible growth of the BRI, market acceptance and transition of environmentally friendly solutions will evolve even further in China and Asia-Pacific economies, he added.

In addition to its top markets of China and India, Covestro, which is headquartered in Leverkusen, Germany, has seen substantial growth in its coatings and adhesives business in the Asia-Pacific region in recent years, particularly in emerging markets such as Vietnam and Indonesia.

A visitor to the first China International Supply Chain Expo in Beijing tries a new energy vehicle. [Photo/Xinhua]

A visitor to the first China International Supply Chain Expo in Beijing tries a new energy vehicle. [Photo/Xinhua]

Sales openings

Zhang Lijun, senior vice-president of Elkem, an integrated silicone manufacturer based in Norway, said the company is eyeing more sales opportunities in China and the Asia-Pacific region.

Listed on the Oslo Stock Exchange, Elkem will invest in new capacities and products in China, with new products set to be launched at its plants in Shanghai and Jiangxi province in the first half of next year.

Zhang said these new investments are aimed at providing advanced silicone products for clients in China and other countries in the Asia-Pacific region.

Data from the Ministry of Commerce show that foreign direct investment into China's manufacturing industry grew by 1.9 percent year-on-year to 283.44 billion yuan ($39.47 billion) in the first 10 months of this year, while that of high-tech manufacturing rose by 9.5 percent on a yearly basis.

Pan Yuanyuan, an associate researcher at the Chinese Academy of Social Sciences' Institute of World Economics and Politics, said China's commitment to speeding modernization of its industrial system has prompted foreign companies to increase their focus on the nation, even in the face of attempts by the United States government to decouple from critical supply chains.

"This has generated higher-level market demand, indicating substantial market potential," Pan said. "Moreover, China holds a superior position compared to many other Asian economies such as India and Vietnam in areas that include financing, well-developed industrial and supply chains, infrastructure, and innovation capabilities."

Nie Pingxiang, a researcher at the Chinese Academy of International Trade and Economic Cooperation, said that as the global economic landscape stabilizes, foreign investment in China is poised to undergo further refinement, in terms of scale and structure. This evolution is likely to be propelled by ongoing improvements to the nation's business environment, Nie added.

"The increasing visibility of China's substantial market size and well-established industrial chains is expected to propel the optimization of foreign investment trajectories," Nie said, stressing that tech-intensive green products will drive multinational companies' investment direction and China's exports in the coming years.

This trend has transformed long-standing competitors into strategic business partners. One example of this is German automotive giants BMW and Mercedes stating early this month that they will collaborate on developing a charging network in China — the largest market for both companies — as part of their accelerated efforts toward electrification.

The two groups will establish a 50-50 joint venture to run the network, with the aim of establishing at least 1,000 high-power charging stations equipped with some 7,000 charging piles by the end of 2026.

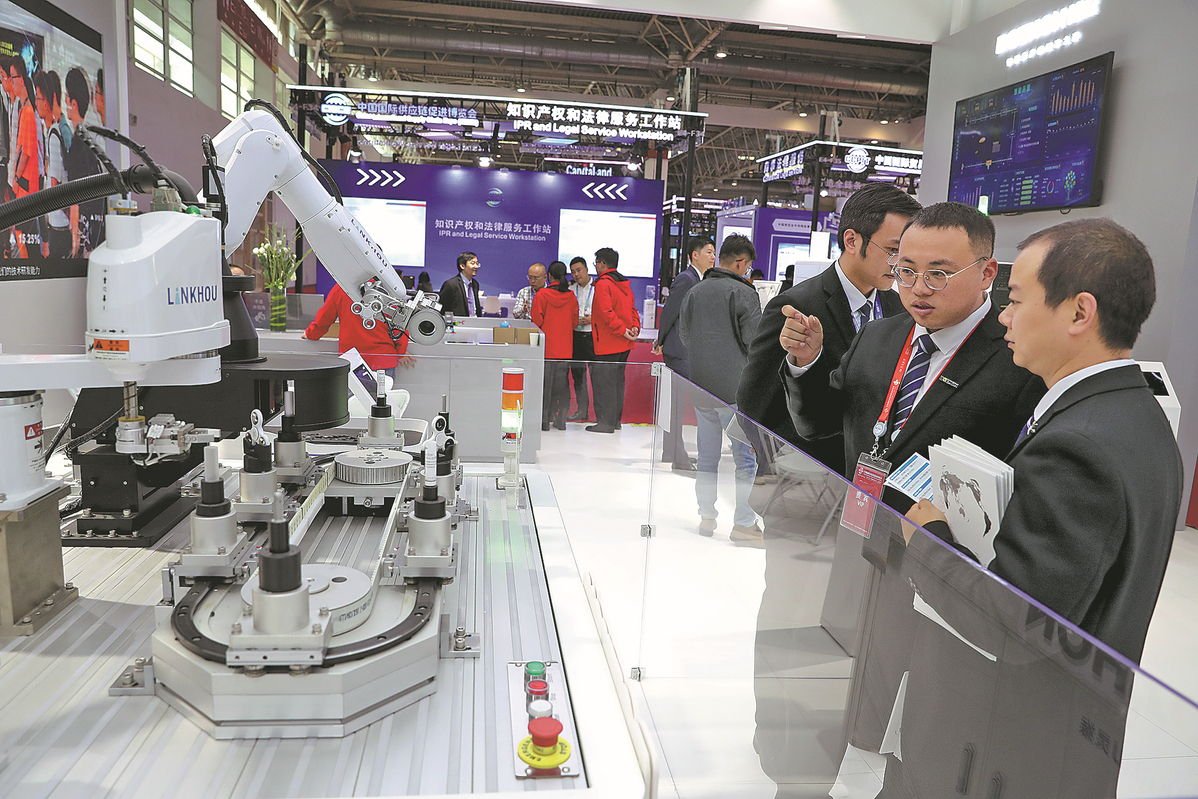

Visitors are attracted by an industrial robot at the expo. [WANG JING/CHINA DAILY]

Despite concerns raised by the US' "decoupling" efforts regarding geopolitical risks, the primary objective for multinationals remains the pursuit of profits and sustainable development.

Wang Xiaosong, a professor of economics at Renmin University of China, said the vast Chinese market and ongoing improvements in the business environment continue to make the country an appealing market for global investors.

French shipping group CMA CGM, eager to secure more market share in China, said early this month it had launched a new service between China and India. Operated by five vessels, the service will cover the ports of Shanghai, Ningbo-Zhoushan, Singapore, Colombo, Mundra and Nhava Sheva.

CMA CGM, which is based in Marseille, France, said the new service connects to its network operating from Southeast Asia via Singapore to ports in India, allowing customers in these regions and around the world to enjoy faster and more convenient services.

Copyright © Xizang Daily & China Xizang News All rights reserved

Reproduction in whole or in part without permissions prohibited

Index Code: 藏 ICP 备 05000021 号

Producer: Xizang Daily International Communication Center